crypto

basistrade

crypto

basistrade

Our platform sets out the framework and offers the tools for programmatic investing into the basis trade strategy

At the base of our approach is an arbitrage strategy known in traditional finance as a “basis” or “carry” trade. This strategy involves taking a long position in an asset (i.e., buying the asset) and simultaneously taking an equivalent short position in a futures contract (i.e., selling the contract). A futures contract is an exchange-traded contract that contains an obligation to buy (if long position) or sell (if short position) an underlying asset at a specific price on a specific date.

For example, a hypothetical basis trade in crude oil futures might look like this1:

On 6 May 2022 crude oil is trading at $100 a barrel (spot price). An exchange offers a futures contract for 1,000 barrels with delivery on 25 July 2022 at a price of $120 a barrel (futures price). An investor could buy 1,000 barrels of physical crude for $100 and simultaneously sell 1 futures contract for $120. They would then store crude and deliver it to the buyer of the futures contract on 25 July 2022 for essentially a risk-free profit of $20,000 (1,000 barrels multiplied by $20 difference between the spot and futures price)2. Given the initial investment of $100,000 to purchase spot crude this represents an absolute return of 20% or 91% p.a. (annualized)

In this example, the investor was able to earn profit on the trade because the futures price was higher than the spot price on the date when the investor entered the trade3.

1 This is a simple illustration of the concept. The actual mechanics of the basis trade in crude oil futures would be different.

2 We ignore storage and other costs.

3 In practice, the futures price will depend on many conditions, and it could be higher or lower than the spot price at any given point in time.

An important feature of this strategy is that it is essentially market neutral. In our example, the investor would realize $20,000 profit when the futures contract expires regardless of whether the price of spot crude increased or decreased from the date when they entered the trade. This is because on expiry the futures price would be equal to the spot price4. For example, if on delivery crude trades at $150 a barrel (both spot and same-date futures price) the investor would have $50,000 profit on their long spot position ($150 - $100) and $30,000 loss on their short futures position ($150 - $120) leading to an overall gain of $20,000. Similarly, if crude trades at $80 spot on delivery the investor would have $20,000 loss on their long spot position ($100 - $80) and $40,000 profit on their short futures position ($120 - $80) leading to the same net gain of $20,000.

Because the strategy is market neutral, it may be used to hedge the underlying asset (crude oil in our example) against price movements. If used as a hedge, the main objective of the strategy is to protect the underlying asset from price volatility. Income generated by the strategy comes as an additional benefit.

4 Otherwise, an immediate profit could be made. If spot crude price is lower than futures price on delivery date the investor could buy spot, sell the futures contract and immediately deliver crude for profit to the futures buyer. Similarly, if spot crude price is higher than futures price on delivery date the investor could buy the futures contract, take delivery of the crude from the futures seller and immediately sell it at spot price.

It is important to note that the spot price will equal futures price at delivery time. Prior to that, the difference between the two (the spread) will change over time due to the change in market sentiment, interest rates, liquidity and other factors.

In our example, the investor put $100,000 into the trade expecting the value of their investment to increase to $120,000 when the futures contract expires. Until that date the value of their investment might temporarily increase or even decrease depending on the movement in the spread. For example, if one month after the initial investment the spot price is $115 and the futures price is $130 (i.e. the spread decreased from $20 to $15) the investor’s position will be worth $105,000 ($115 - $100 + $120 - $130). The investor may choose to realize their $5,000 profit at this point or wait until the spread reaches zero on the delivery date (or sooner) to realize the expected profit of $20,000.

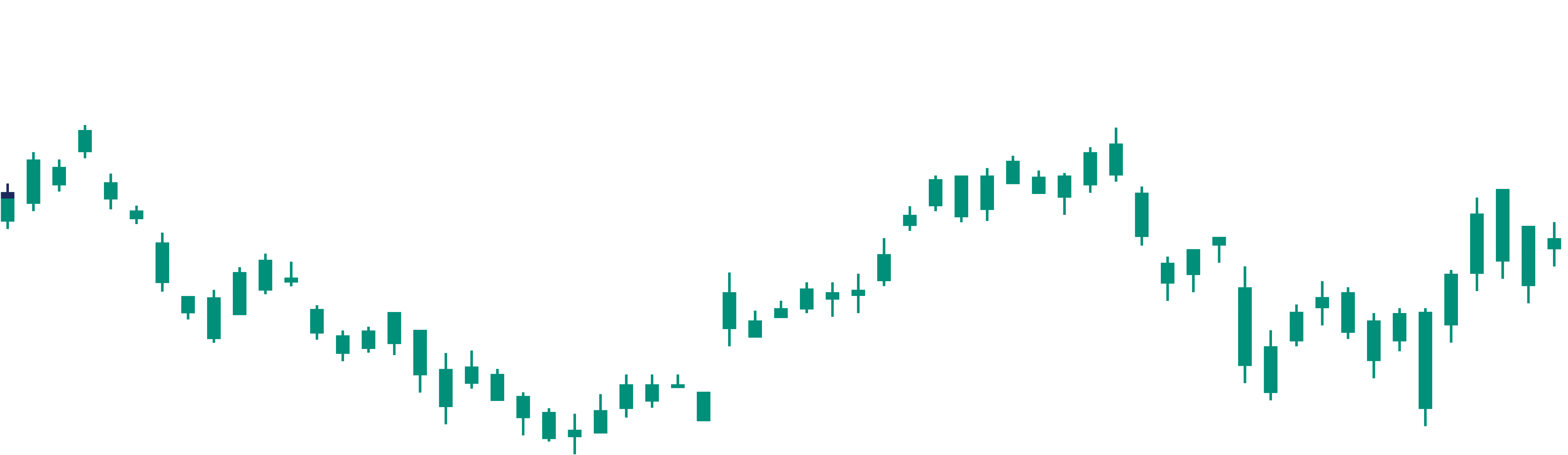

The spread may become close to zero or even negative during the lifetime of the futures contract well ahead of its expiration (typically, if the market sentiment becomes bearish) and investors could earn the expected $20,000 return or more without waiting for the futures delivery date. The spread may also increase above the level at which the investor entered the trade resulting in a temporary decrease in the value of the investment. The key point is that the value of investor’s position increases when the spread decreases and visa-versa, but the spread is “guaranteed” to decrease to zero and investors will realize expected return at the latest on the date when the futures contract expires.

Using our crude oil example, a typical investor journey might look as follows.

The investor has $100,000 to invest in the basis trade. They would monitor the spreads between the spot and futures prices. The investor would consider several futures contracts with different maturities to identify the most attractive spread.

Once the market conditions are favorable the investor would choose a futures contract that offers an acceptable return (e.g., a July 2022 contract with a 20% spread in our example). In choosing the contract the investor would also consider their liquidity requirements since the 20% period return is only “guaranteed” if the position is held until the contract’s expiry (although it might happen that it could be realized earlier as discussed above).

The investor would then buy $100,000 worth of spot crude and sell the equivalent number of chosen futures contracts.

On the date close to expiration when the spread is near zero the investor could close out their position, i.e., sell spot crude and buy back futures contracts realizing their arbitrage profit in cash. Alternatively, if the spreads on other futures contracts with delivery dates further out into the future are attractive the investor could roll – over their short futures position, i.e., buy back previously shorted contracts and sell the equivalent number of longer-dated contracts. This way the investor would continue to generate return by adjusting their futures position close to expiration and without the need to trade spot crude. At any point the investor could exit the trade by selling spot crude and buying back short futures to convert their position to cash.

Some centralized crypto exchanges trade contracts which are similar in nature to traditional futures contracts and can be used to execute “basis trade” in a similar manner. As a result, investors can own cryptocurrencies (long position) and sell an equivalent number of futures contracts (short position) to establish an arbitrage trade locking into the difference between the spot and futures price. For example, if on 6 May 2022 spot BTC trades at $48,500 and the BTC futures contract expiring on 24 June 2022 trades at $50,000 the investor could buy 1 BTC and sell an equivalent number of futures contracts to earn $1,500 for an annualized return of 23%.

According to Bloomberg (link), crypto basis trade described above was one of the most popular and lucrative hedge fund trades in 2021.

Historically, institutions and professional investors have been using regulated exchanges such as Chicago Mercantile Exchange (CME) for this strategy. CME trades “direct” crypto futures where the underlying asset is the price index for the relevant cryptocurrency (e.g., Bitcoin Reference Rates which essentially averages BTC price from major bitcoin spot exchanges). Constructing a basis trade with this type of futures is straightforward. For example, BRR May27’22 futures traded on CME effectively have 5 Bitcoins as an underlying asset (similar to how crude oil futures in our example in the previous section had 1,000 barrels of oil as an underlying)1. Accordingly, the investor would need to simply buy 5 BTC and sell 1 BRR futures contract to set up an arbitrage position.

Regulated futures exchanges such as CME are predominately used by institutions. It may be difficult for a private investor to construct a basis trade on CME as they would need to deal with margin requirements in their brokerage account2.

Certain cryptocurrency exchanges also trade crypto futures contracts. Although their exact name differs between exchanges (e.g., “inverse futures”, “coin-margined futures” etc.) they share a common principle. We would call them “indirect” futures3.

1 In reality, CME BRR futures are index futures with a multiple of 5.

2 The investor could establish a futures position with their broker and a spot position on a cryptocurrency exchange. However, a maintenance requirement on their futures position (typically, 50%) would significantly limit capital available for spot position and thus the overall size of the basis trade. Furthermore, while loss / gain on the futures position will impact the equity in their brokerage account, the offsetting gain / loss on the spot position will not. Accordingly, the investor may have to constantly trade their spot position to meet the margin requirements of their broker (e.g., sell spot cryptocurrency to increase margin on futures when the price goes up).

3 Some crypto exchanges also trade direct futures. However, these tend to be nominated in stablecoins rather than fiat currencies and lack the convenience of using the spot leg of the basis trade as a collateral for the futures trade (see below).

Indirect crypto futures have US dollars as an underlying and are nominated in the relevant cryptocurrency. This is the inverse of direct (regulated) futures which have cryptocurrency as an underlying and are nominated in US dollars. For example, one BTC futures contract on Kraken has $1 as an underlying and may be quoted at a price of e.g., $48,500. Translating to our crude oil example, it is as if the crude futures contract had $1 of underlying and was quoted at $120 per barrel.

To illustrate the mechanics of an indirect future, let’s assume the investor sold 100,000 Jun24’22 Kraken BTC futures for $48,500. If they buy back the contracts now at a price of $46,000, they would have incurred a gain of 0.112 BTC ( $100,000/($48,500-$46,000)). Effectively, the investor’s $100,000 position was initially worth 2.062 BTC ($100,000/$48,500) and then increased to 2.174 BTC ($100,000/$46,000) generating a gain for the difference (0.112 BTC). Note that as opposed to direct crypto futures, the result of trading in indirect futures is calculated in the relevant crypto currency, not USD.

Indirect crypto futures offer several advantages compared to direct futures:

- As opposed to direct futures which are traded on regulated futures exchanges with limited access for private investors, indirect futures are traded on centralized crypto exchanges which are easily accessible.

- Using regulated exchanges requires a brokerage account. The margin requirements in such account would tie up cash that could otherwise be used to establish the spot part of the arbitrage position thus reducing the overall size of the position. However, with indirect futures the investor can use the spot part of the arbitrage position (i.e., coins) as a collateral for the futures part.

- Trading in direct futures on regulated exchanges is dominated by institutions who have the necessary expertise and capital to take advantage of arbitrage opportunities. As a result, these markets tend to be more efficient and offer lower arbitrage returns.

We will use Kraken’s inverse crypto-collateral fixed maturity BTC futures to illustrate the setup of the crypto basis trade.

The investor has $100,000 to invest into the strategy. Let’s assume that on 6 May 2022 spot BTC is trading at $40,000 (spot price). Jun24’22 Kraken BTC future is trading at $48,500 (futures price). The investor could buy 2.5 BTC spot ($100,000/$40,000) and sell 121,250 BTC futures (2.5 * $48,500). Further, close to delivery time on 24 June the investor exists their position when both BTC spot and futures price is $28,0001. They would incur a loss of $30,000 on their spot position (2.5*($28,000 - $40,000)) and a gain of $51,250 ($121,250/($28,000-$48,500)*$28,000) on the futures position for an overall gain of $21,250. We could do the calculation for a different spot and futures price on expiration, but the result would be the same (as long as the spot price equals the futures price which should be the case on expiration). Note that this result will be equal to the difference between the nominal value of investor’s short futures positions (121,250 contracts * $1 nominal per contract) and the amount invested in spot coins when entering the trade ($121,250 - $100,000 = $21,250). In effect, crypto basis trade allowed the investor to lock into a market neutral profit of $21,250. This profit is market neutral in a sense that it does not depend on movement in crypto prices as long as the arbitrage position is held close to maturity.

1 As with direct futures, the futures price should be equal to the spot price at the time of future’s expiration since otherwise immediate arbitrage opportunities would exist.

As illustrated in the crude oil example, investor’s arbitrage position will change in value over time depending on the movement in the spread between the spot and the futures price. Let’s look at possible scenarios:

1) The spread may significantly decrease or even become negative (i.e., spot price higher than futures price) before futures expiration

In practice, this happens when the market sentiment becomes suddenly bearish (normally, accompanied by a significant drop in spot price). Under such circumstances the investor can realize most of their locked-in profit or even more without waiting for the expiration of their futures position. For example, if the entry spread was 4% and it subsequently became just 1% the investor can immediately realize ¾ of their expected profit on the trade.

2) The spread may temporarily increase

This typically happens when the market sentiment becomes bullish. Under this scenario the overall value of investor’s arbitrage position may decrease compared to its initial value upon entering the trade. However, any such decrease is temporary. The spread will eventually decrease to zero as the contracts approach expiration and the investor would simply need to wait until that happens to realize their expected profit.

3) The spread may decrease slowly over time

Under this scenario the spread slowly runs down to zero as futures approach their expiration date. The investor may want to wait until close to the expiration date to realize their expected return on the strategy.

There are periods when cryptocurrencies are very volatile and market sentiment changes quickly. In such markets, the investor may have an opportunity to realize their expected return sooner (as under scenario 1 above). However, the market may also turn suddenly bullish, and the investor may have to wait until the expiration date.

As a general rule, the investor would enter the basis trade when the spreads are high (as in the bullish market phase) and realize their return when the spreads become low (as in the bearish phase).

There are two ways to realize gain on arbitrage position.

First, the investor may exit their position, i.e., buy back the futures and sell spot coins converting everything to cash or stablecoins.

Second, the investor may roll over their futures position into other futures contracts, e.g., into longer-dated futures or futures on another exchange.

The following factors need to be considered when choosing to roll-over or exit arbitrage position:

1) Reinvestment of returns

If the investor wants to realize profit on their position (because the futures contracts are close to expiration or because the spread has fallen significantly prior to that) they need to consider the yield at which they could re-invest the funds into the basis trade. This will be determined by the spreads available for futures contracts at the time of exit / roll-over of investor’s arbitrage position. If the spreads are acceptable the investor may roll-over their futures position into longer-dated contracts. However, if the rates are too low the investor may want to exit the arbitrage trade altogether and hold cash or stablecoins until spreads are attractive again.

Typically, when spreads fall significantly, and the investor gets an opportunity to realize most of their expected arbitrage profit early they would find it difficult to immediately re-invest their funds at an acceptable return (since the spreads on different futures contracts tend to fall and rise together, in annualized terms). In this case they may prefer to fully exit their arbitrage position and wait. However, this may have tax and trading cost implications (see the next point).

2) Capital gains taxes and trading costs

The investor who exits fully their arbitrage position (as opposed to rolling over the futures contracts) needs to sell spot cryptocurrency which they hold. Normally, trading spot cryptocurrencies for cash or stablecoins incurs significantly higher exchange fees than trading futures. Also, selling spot coins may lead to realized gains which could be subject to tax. Tax rules vary between countries and the investor would need to be knowledgeable about taxation regime that applies to them. Some countries exempt capital gains from tax or stipulate a lower tax rate if the coins are held for a certain period of time (e.g., more than 6 months). In such a case the investor may want to hold spot coins longer and trade them less frequently.

The investor looking to establish a position in indirect crypto futures would need to post the relevant cryptocurrency as a collateral to their futures account with the crypto exchange. The exact minimum amount of the collateral would be set by exchange’s rules on leverage. In our example, the investor could place their entire spot position of 2.5 BTC as a collateral in which case there would effectively be no leverage in the account and no risk of liquidation of the futures position1.

However, for security reasons the investor may want to keep only part of their spot position as collateral and the rest in a personal wallet / cold storage. In this case the collateral at the exchange needs to be sufficient to avoid liquidation if the price moves against the investor’s short futures position. Typically, the investor would leave as much collateral as needed for the liquidation price to be significantly higher than the current futures price. This would give them time to move additional collateral from their personal wallet to the exchange if the futures price goes up significantly. Due to the equivalency between the long spot and the short futures leg of the basis trade, there’s effectively no risk of liquidation of the futures position if the investor keeps sufficient collateral in their futures account on the exchange and adjusts it as needed.

1 If the futures price increases the investor would incur a loss in BTC against their initial collateral but that would be compensated by the increase in the USD value of the collateral due to the price increase.

Setting up, monitoring, roll over and exit of the basis trade presents certain technical challenges.

Equivalency between the long spot and short futures position

The key principle of the basis trade is that the long spot position should be equivalent to the short futures position. In our crude oil example, the investor had no trouble establishing an arbitrage position because the futures contract had crude oil as an underlying asset. The contract had 1,000 barrels of crude as an underlying so a short position in one contract would be equivalent to a long position of 1,000 barrels of physical (spot) crude. However, as discussed, indirect crypto futures in effect have US dollars rather than cryptocurrency as an underlying. In our crypto basis trade example above, we needed to calculate the number of futures to sell by multiplying the number of spot coins by the futures price (i.e., 2.5 * $48,500 = $121,250 or 121,250 contracts as each Kraken Bitcoin future has $1 as an underlying).

As futures prices change constantly, the number of futures to sell for a given amount of spot coins also changes. Accordingly, the number of futures contracts equivalent to a given spot position needs to be calculated in real time. This calculation must be made at the exact moment of entering the basis trade (i.e., buy x spot coins and sell the equivalent number of futures) and rolling it over (i.e., buy back futures held and sell an equivalent number of other futures contracts).

Simultaneous trades

Given the need for equivalency between both legs of the arbitrage position the trades to establish, roll-over or exit the position need to be executed simultaneously. If this is done at different times, the position would be unhedged during the time lag and subject to the market risk, i.e., the prices may move against the position.

Spot cryptocurrencies and crypto futures trade on different markets so executing the strategy typically involves a series of simultaneous trades on different markets / platforms.

Investment amount and depth of the order book

As discussed above, both legs of the basis trade must be established simultaneously to avoid the market risk. The same is true for the roll-over and exit of the position. As a result, the relevant orders must be market orders that are expected to execute immediately.

The effective price of executing a market order on a crypto exchange will depend on the depth of the order book for the relevant instrument (cryptocurrency or a futures contract). The order book for a specific instrument is an aggregation of outstanding buy and sell limit orders from other traders. These orders specify the minimum (if sell order) or maximum (if buy order) acceptable price and volume. They are ranked separately as “bids” (buy orders) and “asks” (sell orders) by price from best to worst. If the investor submits a market order to the exchange, it will be matched with the outstanding orders starting from the best available price and until the order is fully filled. For example, if the asks for spot BTC are $40,000 for 0.1 BTC, $40,500 for 0.5 BTC and $41,000 for 5 BTC, a market order to buy 2.5 BTC spot would take 0.6 BTC from the first two orders and 1.9 BTC from the 3rd order. As a result, the effective price to buy 2.5 BTC spot would be $40,860 (and not $40,000 at the top of the book which would only be the case if we were to buy not more than 0.1 BTC).

Various internet resources often quote the price of cryptocurrencies and crypto derivatives as a point price. However, as illustrated above the effective price paid by the buyer or received by the seller using a market order will depend on the size of their order and depth of the order book for a particular instrument at the time when it is executed. The greater the order size and the “shallower” the order book, the greater the extent to which the effective price would be worse than the best price.

The effective prices at which the investor enters, rolls-over and exits arbitrage positions determine the spreads, and hence the arbitrage profit which the investor may lock into or realize. They also directly feed into calculations for establishing position equivalency as discussed above. As a result, the effective prices need to be calculated based on exchange orderbooks in real time.

The Trader tool available on the Cryptobasistrade platform addresses the above challenges programmatically. It does the necessary calculations based on real-time data to provide the user with information on the effective prices and spreads for their intended position as well as execute simultaneous or one-sided trades on one or two different crypto exchanges.

Monitoring the value of the arbitrage position

The value of the arbitrage position at any point in time is equal to the amount of cryptocurrency multiplied by its current spot price.

Over the lifetime of the position the amount of spot cryptocurrency will constantly change reflecting gains and losses on the short futures part of the position. If the futures price goes down the short position will generate gains, if it goes up it will generate losses. Crypto exchanges calculate these gains and losses in real time and record them against collateral (as realized or unrealized depending on the exchange). They are calculated and recorded in the relevant cryptocurrency (not fiat money such as USD).

The overall value of the arbitrage position is the result of two factors: the change in the price of spot cryptocurrency and the change in the amount of spot cryptocurrency due to the change in the price of futures contracts. These factors impact the value in opposite directions. For example, if the spot and futures prices move up the value of 1 coin will increase but the total number of coins will decrease (due to the loss on short crypto futures). On the other hand, if the price moves down the price of 1 coin will decrease while the total number of coins will increase. If the spread between spot and futures prices is unchanged, the absolute movement in the prices will have no impact on the overall value of the position because the change in the price of 1 coin (increase or decrease) will be compensated by the change in the number of coins (respectively, decrease or increase). The overall value of the arbitrage position will only change due to a change in the spread.

Since spot and futures prices constantly change, the accurate valuation and monitoring of the arbitrage position is only possible if the calculation is done in real time.

The Portfolio dashboard available on the Cryptobasistrade platform allows users to track their arbitrage positions based on real time balances and prices.

The crypto basis trade strategy implemented on our Platform requires investors to hold positions in cryptocurrencies and crypto futures which entails certain risks. Some of these risks are discussed below. However, investors should do their own research to make sure they fully understand all risks involved and accept them before using the Platform.

Cryptocurrency technology

Cryptocurrencies rely on complex blockchain technologies which may have bugs and security vulnerabilities in their codebase as well as technical issues with their infrastructure. Although our Platform only supports major cryptocurrencies like Bitcoin and Ethereum that have proven to be relatively secure over time, investor would still need to accept the technological and security risks inherent in owning a cryptocurrency.

Regulations

The regulatory environment for cryptocurrencies and crypto futures varies by country and is subject to change. When considering whether to invest in a basis trade strategy, which cryptocurrency to use and which exchanges to connect to their account on the Platform, investors must assess their compliance with regulations as applicable to them in the appropriate jurisdictions.

Crypto exchanges and wallets

Our Platform only acts as an interface between the user and the connected crypto exchanges where all actual trades to establish, roll-over or exit arbitrage positions take place. Investors’ cryptocurrencies are held directly on the relevant exchanges or in their personal hardware or software wallets.

If the investor loses access to their exchange accounts or personal wallets, they could permanently lose access to their cryptocurrency holdings. Our Platform does not control and cannot recover access to these funds.

All crypto exchanges supported by our Platform are custodial, meaning that they hold users’ crypto funds in their own wallets.

As a result, cryptocurrencies deposited by users to these exchanges are subject to security and counterparty risks, e.g., the exchanges can be hacked or become insolvent due to fraud, mismanagement of client funds etc. leading to the loss of users’ funds.

To mitigate the risk, investors may want to keep most of their spot coins in personal hardware or software wallet rather than on the exchange. However, as discussed in the “Collateral” section above, investors still need to keep some of their spot coins on the futures exchange as collateral for their short futures position.

When generating API keys on the relevant crypto exchange for use with the Platform, we strongly recommend ensuring that these keys do not have permission to withdraw or deposit funds at the exchange. This will further reduce the risk to your funds by making sure that the API keys added to your account on the Platform cannot be used to steal your cryptocurrency.

Crypto exchanges can experience technical issues, including periods of downtime, incorrect pricing and balance information, failure to execute trades etc. This may affect the accuracy of information displayed on the Platform as well as its functionality.

Liquidation

As discussed in the “Collateral” section, users need to keep some of their spot coins as collateral in their account on the futures crypto exchange. The amount of collateral should be sufficient to avoid liquidation of the futures position upon movement in crypto prices. In the event of liquidation, users’ arbitrage portfolio will no longer be hedged and will become subject to price risk on the relevant cryptocurrency. Also, the futures exchange will charge the user a liquidation fee.

The amount of collateral in the user’s account determines the liquidation price for the futures position. Liquidation price should be significantly higher (for short positions) or lower (for long positions) than the current futures price to give the user a sufficient safety margin to avoid liquidation. This safety margin will change as the futures price moves closer or further away from the liquidation price.

The user could deposit all their spot coins as collateral in which case there would be no risk of liquidation as the safety margin will be infinite. However, for security reasons, they may want to keep most of their coins off the exchange and maintain a safety margin at a comfortable level, e.g., at 30%.

Users should regularly monitor the safety margin and deposit additional coins / withdraw coins at the relevant exchange if needed to maintain the safety margin at a comfortable level.

Note that you can find information on the liquidation price and the current safety margin for each of your futures position in the Tiles section of the Portfolio dashboard on the Platform.

For security reasons, all deposits, and withdrawals of cryptocurrencies at crypto exchanges should be done by the users themselves outside of the Platform.

Crypto prices

Crypto basis trade strategy is market-neutral, meaning that the return on the arbitrage position, if held until close to maturity, does not depend on the direction of crypto prices.

Note, however, that at any point in time, the value of an arbitrage position will depend on the spread between spot and crypto prices. After entering the position, there might be periods when the spread widens leading to a decrease in the value of the position. However, this is only temporary as the spot – futures spread will always trend to zero towards the delivery date and the crypto prices would not affect the eventual return when the position is closed or rolled over close to the futures’ expiry.