crypto

basistrade

crypto

basistrade

When to use the basis trade strategy?

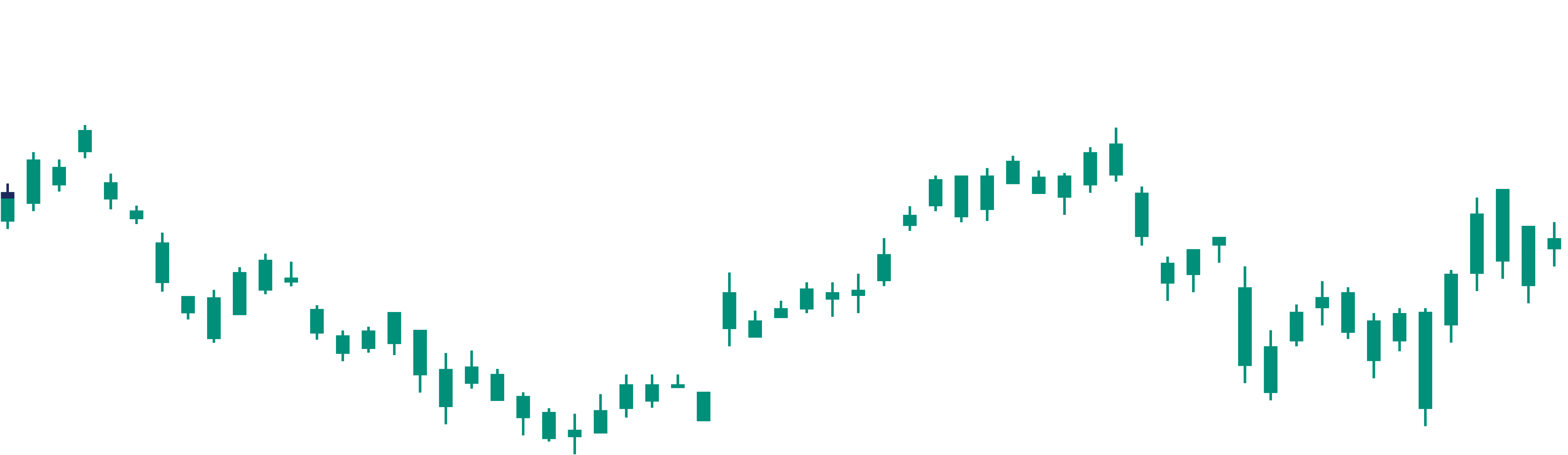

The strategy could be used to generate a predicable market-neutral return or simply hedge market exposure on existing cryptocurrency holdings. It is typically used when price outlook for crypto is uncertain, during market downturns or during periods of low volatility when cryptocurrencies trade in a narrow range. Note, however, that the returns on the strategy tend to be higher in bull markets and particularly around market tops.

What is “portfolio management framework” and how does it work?

Portfolio management framework is a systematic approach to managing an investment portfolio. Our Platform enables users to implement the following approach.

By default, your crypto portfolio is invested into the basis trade and generates a market-neutral return. You can view it as a synthetic “cash” that earns “interest”. If you want to take a directional bet on crypto prices you can open all or part of your portfolio to price exposure (either long or short) and close it back when needed.

This contrasts with a traditional approach where a trader would trade in and out of cryptocurrency for fiat money or stablecoins.

Our approach has the advantage of generating returns when the portfolio is market-neutral / in “cash”. It is also more cost efficient due to lower trading fees (futures vs fiat or stablecoins) and does not require you to incur frequent capital gains / losses on the underlying cryptocurrency (as is the case with active trading).

How do I get started?

Create your account on the sign-up page, generate API keys at supported crypto exchanges of your choice and add them to your Profile page on the Platform.

To understand how the Platform works, you may want to watch the video tutorials in the How-to section of our website. You can also find a detailed description of the underlying methodology here.

Do I need to deposit crypto or fiat funds with the platform?

No, the Platform only acts as an interface between the user and the connected crypto exchanges where all actual trades to establish, roll-over and exit arbitrage positions take place. Users' cryptocurrencies are held directly on the relevant exchanges or in their personal hardware or software wallets.

All deposits and withdrawals from crypto exchanges and wallets are done by the users themselves outside of the Platform.

To use the Platform, the user needs to generate API keys on a supported cryptocurrency exchange and add them to their account on the Platform. For security reasons, please make sure that these keys do not have permission to withdraw or deposit funds at the exchange. Users may also want to add their public wallet addresses to the Platform to have a full view of their crypto portfolio.

Are there any hidden fees charged by the platform?

No, the Platform charges a fixed subscription fee regardless of the value of the investment, transaction volume, or earned income. However, users will incur exchange trading fees, withdrawal fees etc. charged to them directly by the relevant exchange. The Platform has no affiliation with supported crypto exchanges or other service providers.

What cryptocurrencies are available for arbitrage?

Our Platform supports Bitcoin, Ether and Litecoin. Generally, futures and spot markets in Bitcoin and Ether tend to be more liquid and better suited for this strategy.

What exchanges are supported?

We currently support Kraken, Kraken futures and Binance futures exchange. Kraken exchange can be used for the spot leg of the basis trade strategy. Kraken futures exchange (crypto-collateral fixed maturity contracts) or Binance futures exchange (coin-margined contracts) can be used for the futures leg of the strategy.

The basis trade strategy is market-neutral. Does it mean that it’s completely risk free?

Crypto basis trade strategy is market-neutral, meaning that the return on the arbitrage position, if held until close to maturity, does not depend on the direction of crypto prices. However, there are other risks inherent in the strategy such as risks associated with cryptocurrency technology, regulations, crypto exchanges and wallets, position liquidations etc.

In particular, the regulatory environment for cryptocurrencies and crypto futures varies by country and is subject to change. When considering whether to use the Platform, which cryptocurrency to use and which exchanges to connect to your account on the Platform, you must assess your compliance with regulations as applicable to you in your appropriate jurisdiction.

Also, the Platform only acts as an interface between the user and connected crypto exchanges where all actual trades to establish, roll-over and exit arbitrage positions take place. You deposit funds in your personal account with these exchanges and expose yourself to security and counterparty risks, e.g., the exchanges can be hacked or become insolvent due to fraud, mismanagement etc. leading to loss of users’ funds. The Platform is not affiliated with any of the supported exchanges and is not responsible for the custody of users' funds.

You can read more about the risks in the Risks section here.

How do I manage my subscription?

You can update your billing information, view invoice history, or cancel your subscription on your Profile page by clicking the “Manage subscription” button. You will be directed to a Stripe page.

Can I cancel my subscription?

You can cancel your subscription at any time. To do so, go to your Profile page and click the “Manage subscription” button. You will be directed to a Stripe page where you can select “Cancel Plan”.

The cancelation will take effect from the next billing date. Until that time, you can continue using the Platform.

If you want to avoid being charged a subscription fee for the next billing period cancel your subscription at least 24 hours before the next billing date.

The subscription fees already billed are not refundable.